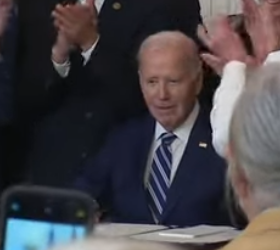

I never thought that it would happen. President Joe Biden just signed the Social Security Fairness Act (HR 82).

Similar legislation has been proposed in every session of congress for the past 40 years. In all that time our senators have assured me that there was a bill pending to eliminate the Windfall Elimination Provision. But no bill ever got passed or even a hearing. Finally, it is done.

On Dec. 20, the Senate passed H.R. 82, known as the Social Security Fairness Act, which repeals both the WEP and GPO provisions of Social Security. The bill previously passed in the House by a 327-75 vote on Nov. 12, President Biden signed the bill today at approximately1:30 PM Pacific Time.

The Social Security Fairness Act provides retroactive payments to those subject to the WEP or GPO in 2024.

The Social Security Fairness Act (H.R. 82), is a bill intended to give relief to individuals who earned a pension from work outside Social Security and who also had also done other work where they paid FICA taxes and therefore earned benefits from Social Security.

In late December, the Senate followed the lead of the U.S. House of Representatives and passed the bill, and President Joe Biden just signed it into law.

This means that, starting retroactively to January 2024, individuals who receive a pension from work outside Social Security and who also have at least 10 years of wages from work covered by Social Security will receive a significant increase in Social Security benefits.

The bill repeals two regulations which reduce benefits for many Social Security beneficiaries. The two provisions are the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO).

When an individual receives a pension from work outside Social Security, the Social Security Administration uses WEP to reduce their Social Security benefit. Now those individuals will receive a higher Social Security benefit.

The GPO provision impacts benefits that an employee would be eligible for regarding spousal benefits and survivor benefits. Those benefits now are reduced by two-thirds of the pension received from work outside Social Security.

The exact amount of increase to your Social Security check will vary depending on your level of qualification but you could easily see it increase by as much as 60%. You should check with www.socialsecurity.gov for details and dates. Since it impacts over two million people it might take a bit of time.